BAC Stock Price Hits All-Time High Amid Market Surge: What’s Behind the Surge?

Bank of America Corporation (BAC) has been doing exceptionally well in the stock market recently, with its stock price hitting an all-time high amid a market surge. The surge has left many investors wondering what is behind this positive momentum and what the future holds for BAC stock.

In this article, we will explore the factors contributing to the surge in BAC stock price and analyze the current market trends that are propelling the stock to new heights. We will also provide insights into the company’s performance, its competitive positioning, and how it is poised to capitalize on the current market uptrend.

Market Surge and BAC Stock Price

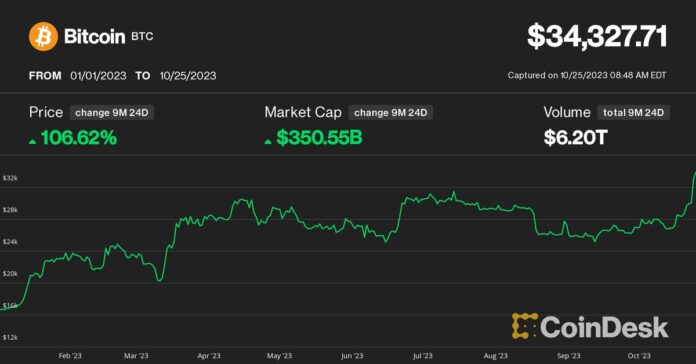

The recent surge in the stock market, fueled by positive economic data, strong corporate earnings, and hopes for a global economic recovery, has lifted many stocks to record highs. BAC has been one of the major beneficiaries of this market surge, with its stock price reaching an all-time high.

The company’s shares have surged more than 50% over the past year, outperforming the broader market. This strong performance has attracted the attention of investors and analysts, who are closely watching BAC’s stock as it continues to climb higher.

What’s Behind the Surge?

There are several factors contributing to the surge in BAC stock price. First and foremost, the company has been delivering strong financial results, driven by robust revenue growth, effective cost management, and a solid balance sheet. The company’s recent earnings reports have exceeded analysts’ expectations, reflecting its ability to navigate the challenging macroeconomic environment and deliver value to its shareholders.

Moreover, the company has been benefiting from the improving economic outlook, as the reopening of the economy and ongoing vaccination efforts have boosted consumer spending and business activity. This has translated into stronger loan demand, higher interest income, and improved credit quality, all of which have positively impacted BAC’s financial performance and bolstered investor confidence.

Additionally, BAC has been making strategic investments in digital banking, technology, and innovation, positioning itself for long-term growth and profitability. The company has been focused on enhancing its digital capabilities, expanding its product offerings, and improving customer experience, all of which are crucial for staying competitive in the rapidly evolving financial services industry.

Furthermore, BAC’s strong capital position, prudent risk management, and disciplined approach to capital allocation have been key drivers of the company’s stock performance. The company’s ability to return capital to shareholders through dividends and share repurchases has also been a contributing factor to the surge in its stock price.

Market Trends and Outlook

The recent market surge has been driven by several key trends that are likely to continue shaping the stock market in the near future. These trends include the ongoing economic recovery, robust corporate earnings, accommodative monetary policies, and continued fiscal stimulus, all of which are supportive of equity valuations and investor sentiment.

Moreover, the low interest rate environment and the steepening yield curve have been favorable for financial institutions like BAC, as they stand to benefit from higher interest income and improved net interest margins. With the Federal Reserve signaling its intention to keep interest rates low for the foreseeable future, BAC is well-positioned to capitalize on this favorable interest rate environment.

Furthermore, the growing adoption of digital banking, the rise of fintech companies, and the increasing demand for digital financial services present significant growth opportunities for BAC. The company’s continued investments in technology, innovation, and customer-centric solutions are likely to drive its future growth and enhance its competitive positioning in the industry.

Additionally, BAC’s strong presence in key markets, its diversified business model, and its extensive product and service offerings provide a solid foundation for sustained growth and profitability. The company’s ability to effectively manage risk, adapt to changing market conditions, and capitalize on emerging opportunities bodes well for its future prospects.

Conclusion

In conclusion, the surge in BAC stock price amid the market surge is reflective of the company’s strong financial performance, its strategic investments, and its ability to capitalize on favorable market trends. As the economy continues to recover, and as BAC continues to execute on its growth strategies, the company is well-positioned to deliver sustainable value to its shareholders and further enhance its stock performance.

Investors should continue to monitor BAC’s financial results, its market positioning, and its ability to adapt to changing market dynamics, as these will be key factors influencing its stock price in the future. With a solid foundation, a compelling growth outlook, and a track record of delivering shareholder value, BAC stands to benefit from the current market surge and remain a strong contender in the financial services industry.