When it comes to borrowing money, finding a lender with competitive rates and favorable terms is essential. With so many options available, it can be confusing to sift through the numerous offers to find the best deal. However, Sainsbury’s Bank offers competitive loan rates for their customers, making it a top choice for those in need of financial assistance.

Sainsbury’s Bank is a well-established financial institution that has been serving the UK market for decades. With a strong reputation for excellent customer service and a range of financial products, including loans, Sainsbury’s Bank is a trusted name in the industry.

One of the key reasons why Sainsbury’s Bank stands out from other lenders is its competitive loan rates. Whether you’re looking to borrow money for a new car, home improvements, or any other personal need, Sainsbury’s Bank offers competitive rates that can save you money in the long run.

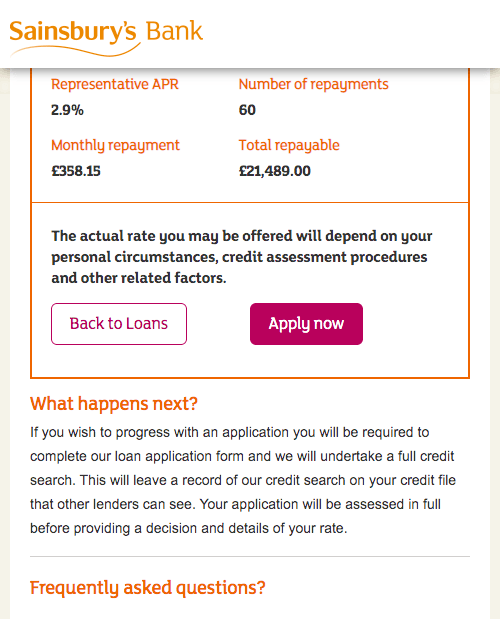

Sainsbury’s Bank offers both personal loans and car loans, with flexible repayment terms and competitive interest rates. Their personal loans start from as low as 2.9% APR representative on loans of £7,500 to £25,000 for terms of 1 to 3 years. For loans of the same amount over 2 to 5 years, the representative APR is 2.9%.

Not only do Sainsbury’s Bank’s loan rates beat those offered by many of their competitors, but they also offer a ‘price promise’ guarantee. This means that if you find a better rate for an equivalent loan elsewhere, Sainsbury’s Bank will beat it by 0.1%.

In addition to competitive rates, Sainsbury’s Bank also prides itself on its straightforward application process. Customers can apply for a loan online or over the phone, and receive a decision in just minutes. For those who are approved, the funds can be in their account the next working day.

Sainsbury’s Bank also offers a convenient online loan management system, allowing customers to easily keep track of their loan and manage their repayments. This level of transparency and convenience sets Sainsbury’s Bank apart from other lenders, making it a top choice for those in need of a loan.

Furthermore, Sainsbury’s Bank provides excellent customer service, with a dedicated team available to answer any questions and provide support throughout the loan process. This level of customer care is just one more reason why Sainsbury’s Bank is a top choice for those in need of financial assistance.

In addition to personal loans, Sainsbury’s Bank also offers competitive rates on car loans. Whether you’re looking to buy a new or used car, Sainsbury’s Bank can help you finance your purchase with rates starting from as low as 2.9% APR representative for terms of 1 to 3 years and 2.9% APR for terms of 2 to 5 years for loans between £7,500 and £15,000.

With such competitive rates, Sainsbury’s Bank makes it easy for customers to afford the car of their dreams without breaking the bank. And with a quick and simple application process, getting a car loan from Sainsbury’s Bank is straightforward and hassle-free.

Sainsbury’s Bank also provides helpful tools and resources to assist customers with their loan decisions. Their loan calculator allows customers to estimate their potential monthly repayments, helping them to budget for the loan and understand the total cost of borrowing.

In conclusion, Sainsbury’s Bank offers competitive loan rates for customers, making it a top choice for those in need of financial assistance. With a strong reputation, excellent customer service, and a range of financial products, including personal loans and car loans, Sainsbury’s Bank is a trusted name in the industry.

If you’re in need of a loan, consider Sainsbury’s Bank for competitive rates, flexible terms, and a straightforward application process. With a ‘price promise’ guarantee and excellent customer service, Sainsbury’s Bank is dedicated to helping customers meet their financial needs with confidence and peace of mind.