If you’re looking to purchase a new home in Australia or New Zealand, ANZ Home Loans can be a great option for financing your dream property. ANZ, also known as Australia and New Zealand Banking Group Limited, is one of the largest and most established banks in the region, offering a wide range of home loan products to suit every borrower’s needs. In this comprehensive guide, we’ll cover everything you need to know about ANZ Home Loans, from the types of loans available to the application process and potential fees.

ANZ Home Loans: Understanding the Basics

ANZ offers a variety of home loan options, including fixed-rate loans, variable-rate loans, and combination loans that allow you to split your loan between fixed and variable interest rates. Fixed-rate loans provide borrowers with the security of knowing exactly how much their mortgage repayments will be for a set period, typically between 1 to 5 years. Variable-rate loans, on the other hand, offer flexibility in repayments, as the interest rate may change over the life of the loan in line with market conditions. Combination loans allow borrowers to hedge their bets by splitting their loan between fixed and variable rates, providing a balance of security and flexibility.

In addition to these basic home loan options, ANZ also offers specialized products such as low deposit loans for first-time buyers, equity loans for existing homeowners, and construction loans for building a new home or renovating an existing property. With such a diverse range of products, ANZ is well-equipped to cater to the needs of a variety of borrowers.

Eligibility and Application Process

To apply for an ANZ Home Loan, borrowers will need to meet certain eligibility criteria, which generally include having a stable income, a good credit history, and a sufficient deposit. The deposit required may vary depending on the type of loan and the borrower’s individual circumstances. First-time buyers, for example, may be eligible for a low deposit loan with as little as a 5% deposit, while existing homeowners looking to refinance or borrow against their existing equity may be required to provide a larger deposit.

The application process for an ANZ Home Loan typically involves completing an online application form, providing documentation to verify your income and assets, and undergoing a credit check. Once your application has been assessed and approved, ANZ will provide you with a formal loan offer outlining the terms and conditions of the loan. If you accept the offer, you’ll then proceed to settlement, at which point the loan funds will be disbursed and the property title transferred into your name.

Fees and Charges

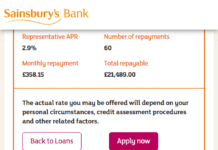

Like any home loan, ANZ Home Loans come with a range of fees and charges that borrowers need to be aware of. These may include application fees, valuation fees, legal fees, and ongoing fees such as annual service fees and account-keeping fees. It’s important to factor these costs into your budget when considering a home loan, as they can add up significantly over the life of the loan.

In addition to these upfront and ongoing fees, borrowers should also be aware of the potential for additional costs such as Lenders Mortgage Insurance (LMI) and early repayment fees. LMI is typically required when you borrow more than 80% of the property’s value, and its cost can be added to your loan amount or paid as a lump sum at settlement. Early repayment fees may apply if you choose to pay off your loan early or make extra repayments, so it’s advisable to check the terms and conditions of your loan before doing so.

Interest Rates and Repayments

The interest rate on your ANZ Home Loan will depend on the type of loan, the amount you borrow, and the loan term. The interest rate may be fixed for a set period, after which it will revert to a variable rate, or it may remain variable throughout the life of the loan. ANZ offers competitive interest rates compared to other major banks in Australia and New Zealand, and borrowers may also be eligible for discounted rates if they have other banking products with ANZ, such as a transaction account or credit card.

When it comes to making repayments on your home loan, ANZ offers a range of flexible options to suit your individual needs. These may include weekly, fortnightly, or monthly repayments, as well as the ability to make extra repayme